Fidelity International Strategic Ventures We partner with bold, innovative founders shaping the future of finance.

We make meaningful venture investments across the globe that are strategic to Fidelity International.

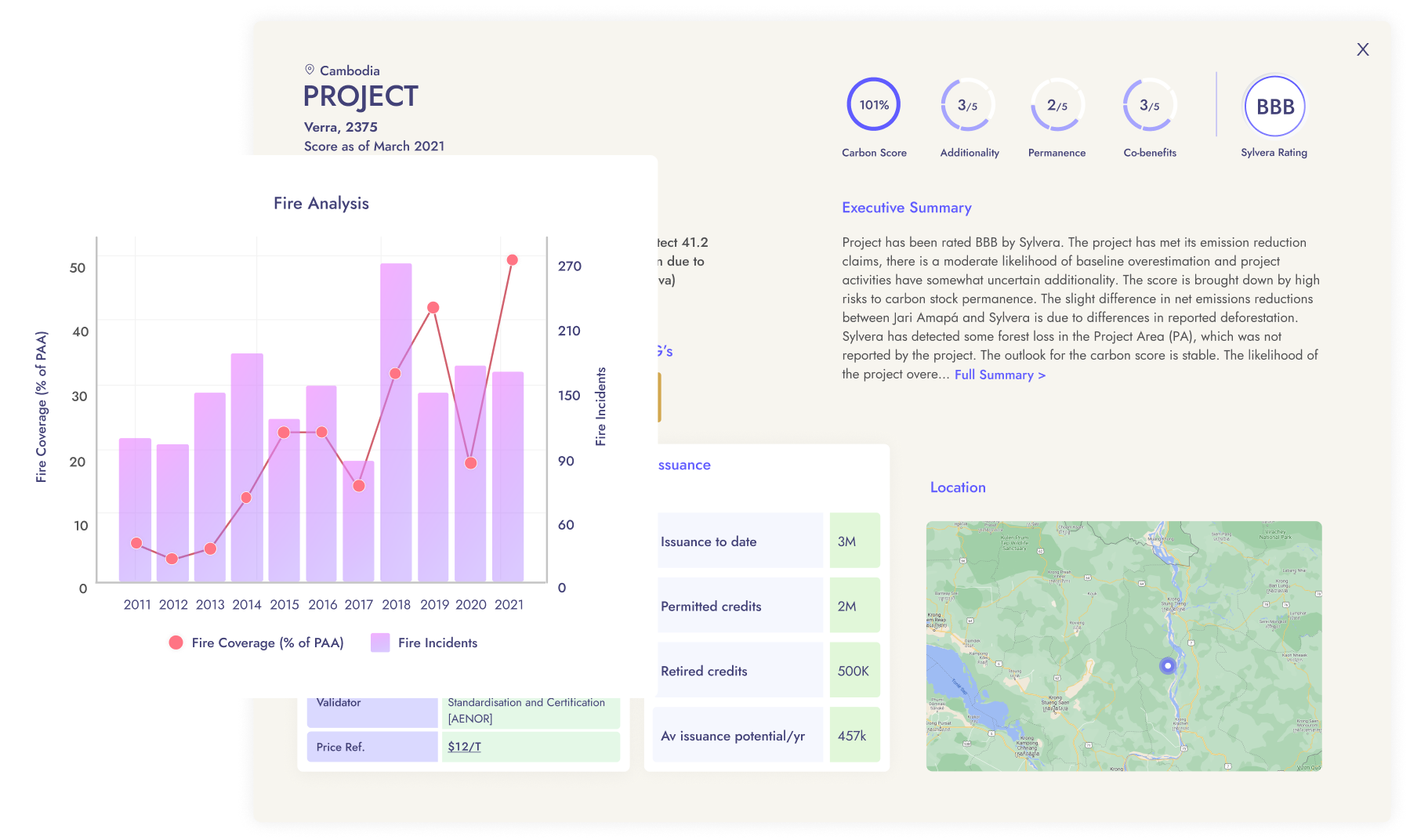

Our portfolio in detail

$260

deployed

10

team members

75%

portfolio strategic implementation

We provide strategic operational support and fintech domain expertise.

Read our perspectives"Having FISV on the board is a privilege. They provide profound insights, support and empower us, and help us getting to better decisions and the right people." Eran Haggiag

co-Founder & CEO, Glide Identity

"FISV have been engaged throughout. Their work with us in engaging with the Fidelity Funds Network team in the UK & Japan has been exemplary." Mark Evans

President & CEO, Conquest

"Beyond access to capital, their team has helped guide our strategy and has been a hugely valuable sounding board throughout our journey." Ben Stanway

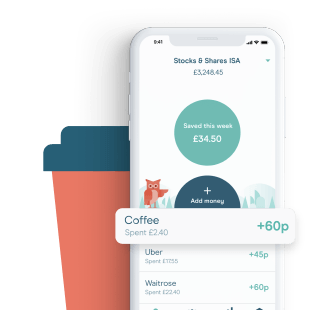

co-Founder & CEO, Moneybox

"Great team with a clear sense of purpose, vision and really great people to work with."

"It's a world class team. I feel comforted to have them as partners." Matt Smith

co-Founder & CEO, SteelEye

We unite a community of fintech entrepreneurs to cultivate unique opportunites for collaboration.

Read our case studiesLatest updates

Glide Identity

Glide Identity raises $20m Series A

Fidelity International

Four of the FISV portfolio make CNBC's list of the world's top fintech companies

Fidelity International

Josh featured in Startups Magazine

Perspectives

Article

Building genuine connections

Danica Histed

5 min

read

Article

Thinking of hiring a CRO? Read This First

Emily Havers

7 min

read

Article

The UK's Fintech Edge: How to Keep the Crown

Alokik Advani

10 min

read

Article

The Future of Finance is Fractional

Marcello Melandri

6 min

read

Article

Back Office to the Future

Joshua Lloyd-Lyons

10 min

read

Audio

FISV features on GCV's CVC Unplugged Podcast

Alokik Advani

listen

Article

The Great Wealth Transfer: A new era in wealth management

Marine Augé

15 min

read

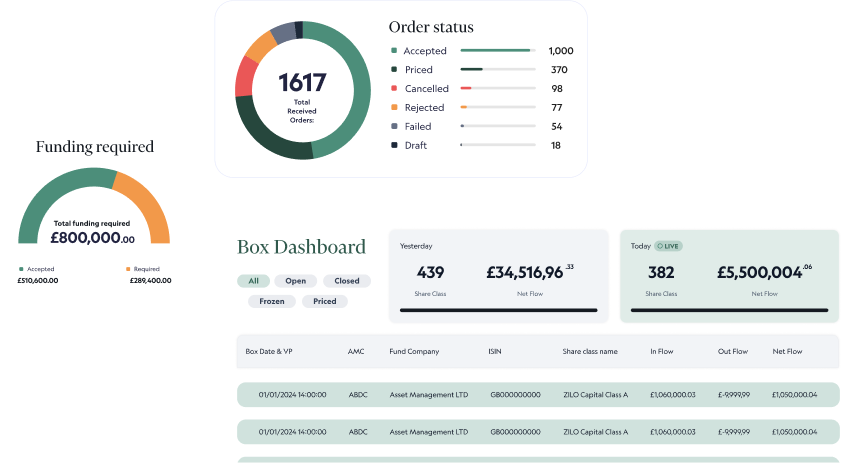

One Year On: Fidelity and Quantifeed's Strategic Asset Allocation Tool

7 min

View all perspectives

53 more

.png)